The Federal Government has revealed plans to integrate over 20 per cent of unbanked Nigerians into the banking system.

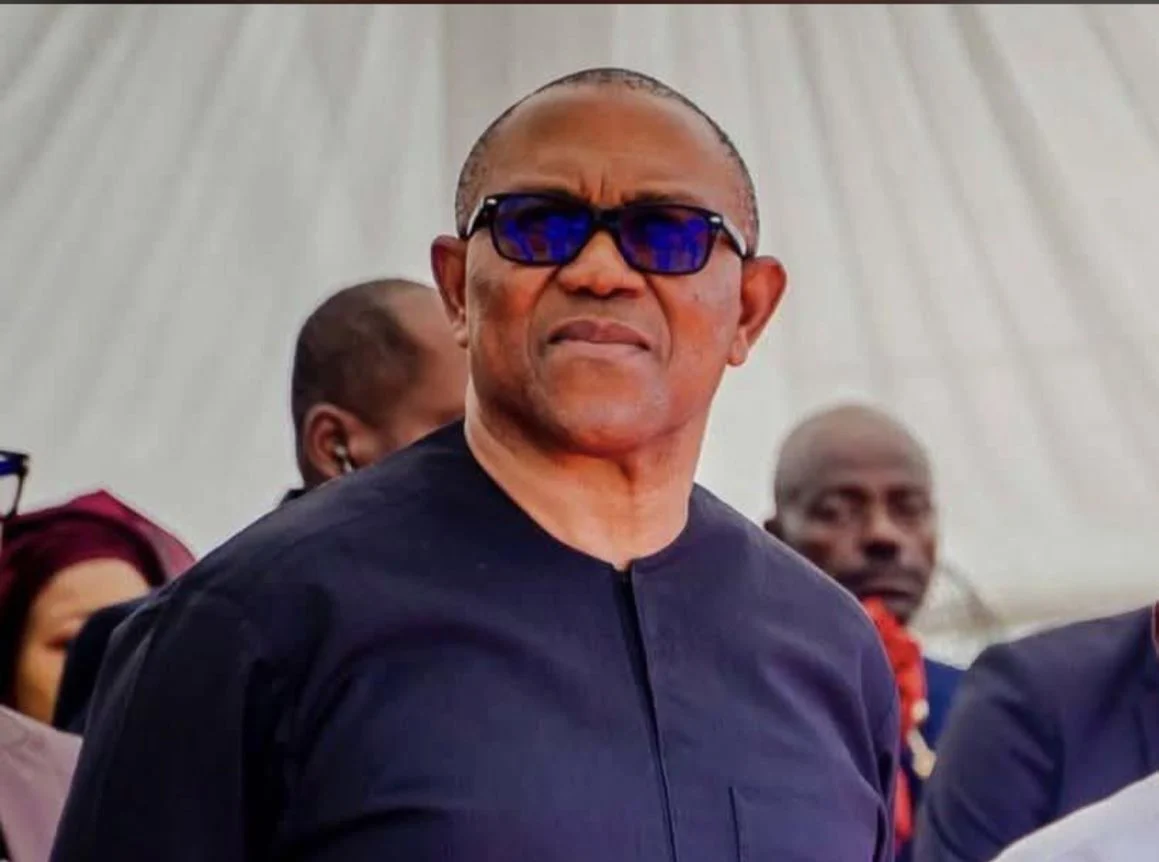

Vice President Kashim Shettima revealed this in Abuja on Thursday at the beginning of a two-day National Stakeholders’ Workshop on Economic and Financial Inclusion.

According to the vice president, at least, over 20 per cent of Nigerians are currently excluded financially.

He added that the government was targeting to reduce that number to a minimum of five per cent.

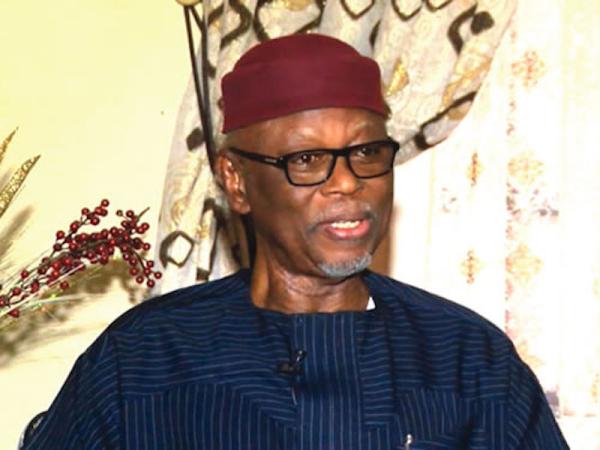

At the event, the 14th Emir of Kano and former Governor of the Central Bank, Sanusi Lamido, said banditry and other security challenges in Nigeria can be attributed largely to financial exclusion. as many rural dwellers have no access to efficient payment systems

The workshop focuses on how to integrate the unbanked Nigerian population into the formal financial system in Nigeria. It brings together experts from all walks of life, including the Central Bank Governor, Olayemi Cardoso, traditional rulers, and private sector players.

Ahead of the event, the Deputy Chief of Staff to the President, Senator Ibrahim Hadejia, said the FG would tackle poverty and insecurity head-on across the country through financial inclusion for all Nigerians.

Hadejia said: “Economic and financial inclusion are essential components of President Tinubu’s agenda to assist in integrating the underserved and unbanked into the formal financial system. This will enable Nigerians to access a range of financial services at a reasonable cost.

“Such services include transaction accounts, savings, payments, transfers, credit, pension, e-commerce, and insurance (including health insurance) within proximity to their place of work or residence. Economic security underlies the principle of financial inclusion.”

This is as President Bola Tinubu has approved the takeoff of the first phase of the Consumer Credit Scheme (CCS) to empower Nigerians to improve their quality of life through access to goods and services. Announcing Tinubu’s approval on Wednesday, his Special Adviser on Media and Publicity, Ajuri Ngelale, described the scheme as the lifeblood of modern economies.

“This scheme will facilitate crucial purchases, such as homes, vehicles, education, and healthcare, essential for ongoing stability to pursue their aspirations,” Ngelale said.