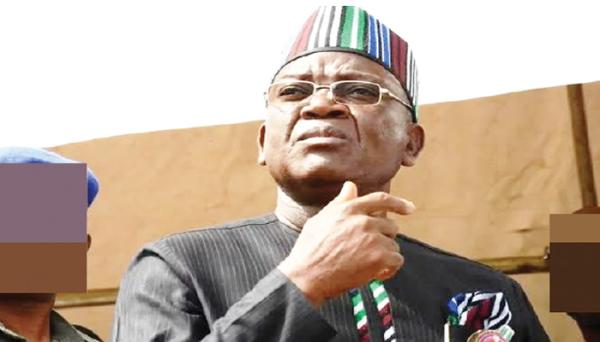

The Benue State Board of Internal Revenue Service, BIRS, weekend sealed off the premises of Oracle Business Ltd, owned by former Governor Samuel Ortom over an alleged N93.5 million tax default.

Also sealed in the Makurdi operation led by the BIRS acting Chairman, Mr. Sunday Odagba and Board Secretary/Legal Adviser, Mr. Ushahemba Dekaa were Jagshu Filling Station over alleged N2.1millon default and Ubgechi Filling Station also in default of alleged N2.1million.

The enforcement was a sequel to an order of a Makurdi High Court empowering the Board to enforce the consequences of the default.

Speaking after Oracle Business offices were sealed in parts of the town, the BIRS Legal Adviser pointed out that the company failed to meet its obligations for upward of six years and the Board had no option but to wield the big stick.

He said: “We have had time to assess the tax of the company all along. They have had to go back and forth in relation to payment which they failed to do. And we have had several meetings and engagements with them. In fact, at some point we were even pampering them to ensure that they paid their taxes and levies but they failed to.

“So today we had to come and enforce the Court Order we got from the High Court of Justice just because they have failed to pay their taxes.

“The tax liability of Oracle Business is about N100millon and it has been standing there for well over six years. In fact, it is one of the companies that refused to pay tax to the government despite their activities we felt that it is incumbent on them to pay their tax, and where you fail to do, the law will take its course and that is why we are here today.”

“I must point out the Group Managing Director of the company claimed that they paid N38million which is not true. Even our acting Executive Chairman had to come in to persuade them to pay but they refused. Since there has to be an element of coercion to ensure tax payment, that is what we have done today on behalf of the acting Chairman of BIRS.”

On his part, the Group Managing Director of Oracle Business, Chris Omiyi argued that the company got letters of tax evaluation totalling N138million. “We sent our tax consultant to them and the liability dropped to N38million.

“Even that amount was spurious but because we are peace-loving we agreed to pay the N38 million. But there is still a dispute of N15 million which we are to resolve in the office. They fixed a date for the resolution, we got there the people we dealt with were not on seats.

“The issue is that you said a company is owing tax and we have started paying what you said we are owing. Whatever that is in dispute we bring it forward and if it is overruled then we pay that which is in dispute because we have paid all others.”

Reacting, the BIRS acting Chairman noted that Oracle Business and others failed in their obligations “because we had served them demand notices, they did not object and they did not pay.

“And the law is very clear, if you are given an assessment you should pay or you object to it. If there is no objection then within 30 days you should go and pay the tax liability. But they ignored all these hence the decision to seal them.

“The reason for the sealing the affected organisations is for tax default and nothing more. This operation has no political coloration whatsoever as somebody tried to claim. It is simple, if you have paid your tax as stipulated by the law, all you need to do is present the receipt, that is all.

“For your information we are also moving to Gboko and Otukpo Zonal Offices very soon to carry out the same operation. So we are appealing to those owing to pay up immediately.”