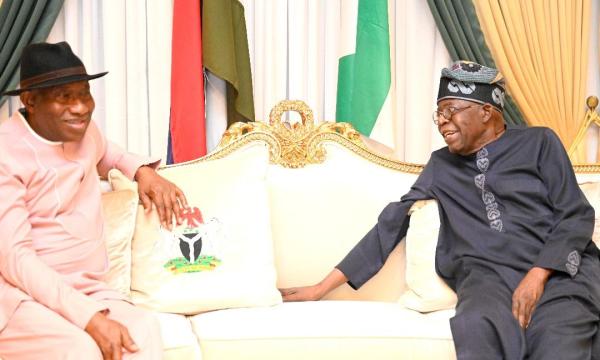

Nigeria President Goodluck Ebele Jonathan

President Goodluck Jonathan will this morning formally flag-off the disbursement of the N220 billion Micro, Small and Medium Enterprises Development Fund (MSMEDF) in furtherance of his administration’s efforts to enhance micro enterprises’ contributions to the nation’s Gross Domestic Product.

Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, disclosed this at the opening session of the 8th Annual MSME Finance Conference with the theme “MSME Financing in Nigeria: Past, Present and Future” in Abuja.

He said the forum was conceptualised to look at the MSME finance subsector from a holistic perspective with a view to enabling stakeholders contribute on how to improve its performance on a sustainable basis.

Emefiele added that in disbursement of the funds to the entrepreneurs through Participating Financial Institutions (PFIs), the apex bank had instituted an Entrepreneurship Clinic where aspiring young entrepreneurs would be trained and mentored and provided with required tool kits to start and grow their businesses.

He said as part of the strategies to achieving this goal, 60 enterprising graduates had been invited to the programme to be trained and mentored on how to identify business opportunities and source finance.

The CBN boss said the young entrepreneurs participating at the session would be monitored with respect to the progress and achievements recorded before the next conference, even as he urged the private sector to collaborate with the apex bank to improve access to finance to the SMEs in view of the limited amount of funds it has committed to this venture.

Emefiele noted that relative to both global and sub-Sahara African growth trajectories, Nigeria had achieved remarkable economic growth and development in recent years as a result of the resilience of our people, the innovativeness of our enterprises, and the programmes of our governments at all levels. Specifically, he pointed out that in the last seven years, Nigeria’s economy had expanded by an average of 7 percent, while sub-Sahara Africa’s real GDP growth averaged 5.2 per cent.

He, however, stressed that sustaining the developmental strides with a balanced and inclusive economic growth will depend largely on the provision of affordable and efficient financial services to the MSMEs, particularly the micro entrepreneurs who account for more than 90 percent of the MSMEs in Nigeria.

Emefiele said: “It is imperative that this segment of the financial system be strengthened in order to forestall the inevitable adverse socioeconomic consequences of financial exclusion.

“The linkage between finance and economic development has been well documented. Access to finance has a significant multiplier effect on the economy because of its catalytic effect on job creation and poverty reduction.

“It is in realisation of this that the CBN launched the N220 billion MSME Development Fund to provide financial resource to the entrepreneurs across the country through Participating Financial Institutions (PFIs),” he added.

According to him, since the said access to finance always has multiplier effect on the economy, especially with the catalytic effects on job creation and poverty reduction, it was therefore for this positive implications that the apex bank launched the N220 billion MSMEs Fund to provide financial resources to entrepreneurs across the country though participating financial institutions. Emefiele said he was happy that the President had accepted to flag-off the disbursement of the fund today.

He expressed the hope that the 2014 conference would help to consolidate efforts towards the empowerment of entrepreneurs while formulating policies that would help to address the challenges of that sector of the economy.