The Nigeria Deposit Insurance Corporation (NDIC) has advised operators of Primary Mortgage Banks (PMBs) in the country to always comply with regulatory policies so as to avoid the build-up of risk in the sub-sector.

The regulatory body also stated that given the high cost of cleansing the system of toxic assets of deposit money banks through the Asset Management Corporation of Nigeria (AMCON), the supervisory authorities are deeply concerned about the build-up of toxic assets of microfinance banks (MFBs), which stood at about 45.70 per cent as at December 2013, as against the prescribed maximum of five per cent.

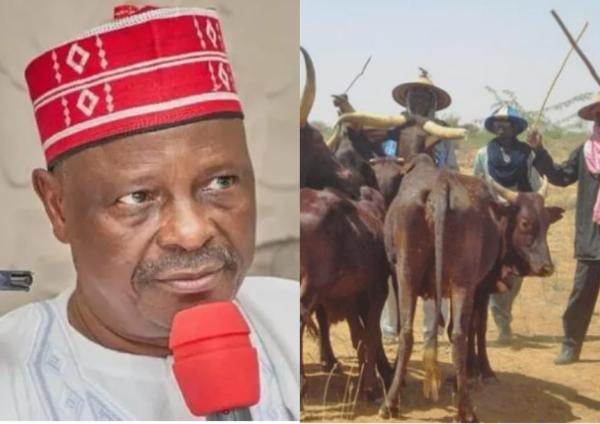

Managing Director, NDIC, Alhaji Umaru Ibrahim who stated this in a keynote address delivered at the 2014 sensitisation workshop for operators of PMBs organised by the corporation in Lagos yesterday, pointed out that the corporation’s attention is now “being focused on both MFBs and PMBs so as to address the emerging challenges.”

According to him, “our efforts can only be successful if the operators can embrace good corporate governance and sound risk management practices.”

The NDIC boss pointed out that the institutionalisation of the Nigeria Mortgage Refinance Corporation (NMRC) as a wholesale financial institution that refinances portfolios of PMBs and deposit money banks (DMBs) implies a shift of required core competences of PMBs to areas such as deposit mobilisation, creation of risk assets, among others.

Furthermore, he stressed that the creation of the NMRC, a market of more than N59.5 trillion, implied that PMBs are set to experience phenomenal growth.

He added: “You may recall that the global financial crisis of 2007 to 2009 was mainly due to the problems in the US mortgage sector. As we are well aware, the mortgage markets are inextricably linked to the functioning of the economy, both in the United States and worldwide.

“The US subprime mortgage crash exacerbated by the interconnectedness between real estate and financial institutions, as well as poor corporate governance practices and weak risk management at many systemically important financial institutions, led to one of the biggest crisis the world has ever witness.”

Ibrahim noted that weak corporate governance and weak risk management could result to risky behaviours by PMBs, thereby creating huge toxic assets.

According to him, the workshop was to sensitise operators on their responsibilities in order to ensure that they run their institutions in safe and sound manners as well as to take advantage of developments in the economy.

He also said the programme became necessary because of growing opportunities for the operators to finance more housing delivery and to access cheap and long term funds.