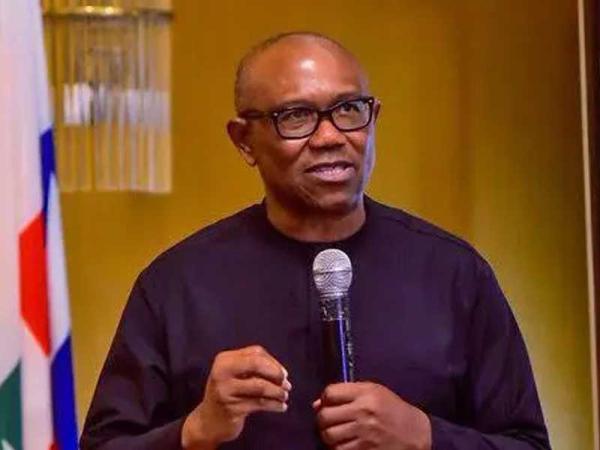

Nigeria's President Bola Tinubu has announced 0% VAT for essential goods and services.

This means that Rents, Public transportation and renewable energy will be fully exempt from paying Value Added Taxes, VAT.

The President, who made this known in his 2nd year anniversary statement, said this move is being made to ease the burden of cost on households. He also mentioned that essential goods such as food, education and healthcare will now enjoy 0% VAT.

In his words;

‘’One of our administration's most impactful achievements is our bold tax reform agenda, which is already yielding results. By the end of 2024, our tax-to-GDP ratio rose from 10% to over 13.5%, a remarkable leap in just one year. This was not by accident. It results from deliberate improvement in our tax administration and policies designed to make our tax system fairer, more efficient, and more growth-oriented.

We are eliminating the burden of multiple taxation, making it easier for small businesses to grow and join the formal economy. The tax reforms will protect low-income households and support workers by expanding their disposable income. Essential goods and services such as food, education, and healthcare will now attract 0% VAT. Rent, public transportation, and renewable energy will be fully exempted from VAT to reduce household costs further.

We are ending the era of wasteful and opaque tax waivers. Instead, we have introduced targeted and transparent incentives supporting high-impact manufacturing, technology, and agriculture sectors. These reforms are not just about revenue but about stimulating inclusive economic growth.

There is a deliberate focus on our youth, who a friendlier tax environment for digital jobs and remote work will empower. Through export incentives, Nigerian businesses will be able to compete globally. Our National Single Window project streamlines international trade, reduces delays, and enhances Nigeria's competitiveness.

To promote fairness and accountability, we are establishing a Tax Ombudsman, an independent institution that will protect vulnerable taxpayers and ensure the system works for everyone, especially small businesses.

Most importantly, we are laying the foundation for a more sustainable future by introducing a new national fiscal policy. This strategic framework will guide our approach to fair taxation, responsible borrowing, and disciplined spending.

These reforms are designed to reduce the cost of living, promote economic justice, and build a business-friendly economy that attracts investment and supports every Nigerian. Together, we are creating a system where prosperity is shared, and no one is left behind.''