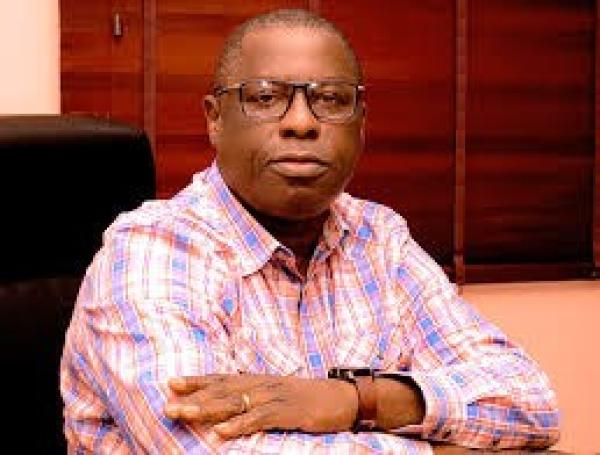

Mr Philip Ihenacho is the CEO of Seven Energy International Limited, an independent Nigerian integrated oil and gas company. In this interview with Chika Izuora, he shares his views on gas development and potentials in the sector.

Since the commissioning of the Uquo Gas Processing Facility what has been the experience so far?

One of our key areas of focus since the official commissioning has been to connect our gas infrastructure with that of Nigerian Gas Company (NGC’s) in the area of our operations to allow us to deliver gas all the way from Eket, where the Uquo Gas Processing Facility is located, and via our Gas Receiving Facility at Ikot Abasi, to Aba, Port Harcourt and Calabar.

This project has already been completed and we are in the process of commencing the supply of gas to the Calabar NIPP power station and the Alaoji NIPP power station, in addition to the UniCem cement plant, the Ibom Power station and the Notore fertilizer plant, which we are already supplying through our gas infrastructure. Considering the potential power generation capacity of the Calabar NIPP power station of 560 Megawatt (“MW”) and the Alaoji NIPP power station of 1,000 MW, there is in excess of 1,500 MW of power generation capacity awaiting gas supply and to be added to the national grid upon the commencement of the supply of gas to these power stations. This will significantly increase Nigeria’s generation of power.

What is your assessment of the domestic Nigerian gas market, given your experience to date?

The domestic market for gas in Nigeria is potentially very large. When you talk about gas, you are talking about energy.

Most consumers of diesel for electricity generation could be gas consumers. If those who are running diesel generators at a very high cost and using a source of fuel that is very damaging to the environment could move to gas, the demand will be huge.

The only challenge is the significant gas infrastructure deficit that Nigeria is currently experiencing.

There is no shortage of demand but a shortage of gas infrastructure which is required in order to deliver gas to the end customers.

So what are the key opportunities and challenges?

The key opportunity is in the supply to the power sector, the industrial sector and even the transport sector.

Most forms of transport, whether it be buses or lorries, can move from consuming diesel to gas.

Compressed natural gas is a much better option for the environment. It is also cheaper.

The key challenge is that unlike diesel, where all that you need to do is put it on a lorry and transport it by road, gas is much more difficult to transport and to reach your end customer.

Gas is most effectively delivered by pipelines, which means that you have to build pipelines in the ground to reach your end customers.

It is possible to deliver some quantities of compressed natural gas or liquefied natural gas by road but those quantities would be relatively small.

To be able to deliver gas to major power stations, you would need a medium- to long-term strategy focused on delivering the necessary gas infrastructure, connecting supply with the demand.

Construction of gas infrastructure takes time and skill. Construction of pipelines is particularly challenging and you face not only construction risks but also community and right-of-way issues.

When handled with care, these issues can be overcome, but it takes time and commitment.

We have invested heavily in our community relations and we have learnt through years of experience how to effectively lay pipelines and what good community relations are all about.

In summary, with the strong demand profile, the opportunity is great, but dedication to a medium-to-long term strategy, supported by a strong community relations programme are key to be able to benefit from this demand curve and opportunity.

As a result of the ongoing deficit in domestic gas infrastructure in Nigeria is trucking of gas to key customers a better option?

It is a possibility but it really depends upon the size of the power station. In order to deliver gas by trucks, one would either need to compress or liquefy the gas in order to reduce the gas volume and make it suitable for such road transportation.

In fact, this is already happening in Lagos and in Benin. It is a proven technology.

Could gas be delivered in such a way to a power station to generate electricity?

Its possible for smaller power stations. The problem is the number of trucks and journeys that is required. If you are going to supply a larger power station, it may take many truck loads of gas per day.

For a smaller power station (e.g. 10 to 100 MW),liquefied natural gas or compressed natural gas, delivered by road, could be a solution but it could also be an interim solution before a more effective, and long-term supply option, using gas pipelines, is developed.

Since June last year, the price of oil has fallen close to 60 per cent. Should we expect drop in capital expenditure for gas exploration projects in Nigeria?

Oil and gas generally come together. Gas is produced when you produce oil, therefore with the low oil prices, a lot of the oil and gas companies have reduced their expenditure to produce oil, and hence indirectly reducing their expenditure to produce gas.

In the near-term, this will have a negative impact on the development of gas resources in this country. In the medium-term, however, the differential with the profitability of oil and the profitability of gas is expected to be less.

For a long time, oil has been very profitable and gas has been far less profitable, especially in this market.

Now the oil price has dropped and currently remains low, whilst the gas price is on a continuous rise. What this means is that more oil and gas companies will start to take the gas opportunity more seriously.

So in the medium-term, I would expect more forward-looking oil and gas companies to join us in the gas race.

So generally it is positive news for the domestic gas sector in Nigeria?

It is positive news for the medium-term. For the short-term, however, everybody is cutting their budgets, and when they cut their budgets, they typically are cutting budgets which would have been producing gas as well as oil.

During your presentation at the NOG Power Forum, you said the future of the power sector reform is tied to meeting the deficit in the supply of gas. Can you shed more light on this?

From the perspective of a gas producer and supplier, the single biggest source ofdemand will come from the power sector. If you are trying to do well in the gas business, some 50 per cent of your customers are going to be power customers and your fortune is going to be tied to your customers’ fortune.

If your customer is not doing well, indirectly it will affect you.

What has happened historically in Nigeria is that we have had a tradition ofnon-payment throughout the whole power sector, as well as illegal tapping of electricity lines. What this has meant is that the distribution companies have not been able to collect money for the electricity.

The spiral effect is that the distribution companies are not paying the money that they are supposed to pay to the generating companies to generate electricity and the generating companies are not paying for gas supplied to them.

So at each level of the chain, you have a tradition of non-payment and unless thischanges, we have a huge problem in Nigeria. We must have a “Gas to Power” sector that works and for it to perform and operate as it is done in any other viable industry.

The fulfillment of payment obligations will also further the investment levels in the sector.

Therefore, one of the key challenges that we have, as a Company, is to ensure that we are very careful about how we contract with our customers.